I don’t routinely buy travel insurance. I have insurance that covers my medical expenses (at least to a point) if I am in another country. Therefore, the only reason I thought I needed travel insurance was to reimburse me for the cost of a trip if it were to cancel for some reason. Only when the cost of a trip was too pricey to risk losing, would I begrudgingly agree to the extra expense of travel insurance. When I did buy travel insurance, I just bought whatever the travel company offered and never read the policy.

As luck would have it, I bought travel insurance before heading off to Africa for three weeks this past January. Africa is a stunningly beautiful place, at least what I saw of it. Seven days in, during a jeep ride across the Okavango Delta, the jeep fell into a hole and I injured my back. Eventually, I made it out of the Delta and into an emergency room in Cape Town. After an x-ray, an MRI, and a consultation with three doctors ( for a total cost of 267.00 American dollars by the way), I was told my back was broken, that I had to lay flat for six weeks , and that I was being admitted to Christiaan Barnard Hospital to recover. It is a wonderful hospital but six weeks there seemed a little excessive to me. I was in a brace, had no real pain, and wanted to go home. My doctor told me that if I could arrange a stretcher flight, I could leave anytime. And so, my travel insurance odyssey began…

I contacted my travel insurer and confirmed that, not only did I have trip cancellation and interruption coverage, but I also had medical coverage and $100,000 in repatriation coverage to get me home. I was told that none of this coverage would be available to me until the company confirmed my injury and accepted my claim. I was also told that once coverage was confirmed, a stretcher flight to the U.S. could be arranged in 4-7 days. I prepaid a week’s hospital and doctor expenses out of pocket and waited for the coverage determination. The company eventually approved the claim after a week and turned the claim over to a third-party administrator. I spent three weeks in the hospital before this company scheduled my flight home. They were purportedly waiting for my doctor to sign various forms. I saw him every day. He had no idea what forms they needed. During this time, I had emails from 15 different adjusters none of whom apparently communicated with any of the prior adjusters. Every one of these adjusters just sent emails saying they were waiting on forms. I had become a “file.” There was no supervising adjuster on my file as all file questions were handled by whomever was working at any given moment. Apparently, no one read anything more than the most recent entry. In the third week, the adjuster of the day asked for my doctor’s name…. the one they had been sending forms to for signature. Someone finally sent me the form they claimed to need (which the doctor had sent back weeks earlier) and I had him sign it again. Four days later, I had a ticket on Lufthansa for an 18-hour stretcher flight to Chicago through Frankfort. I could not leave, however, until my two “escort” nurses to got to Cape Town from the U.S. Lufthansa does not allow unescorted patients on their planes and insists on two nurses. In my case they flew roundtrip over 36 hours to take my blood pressure.

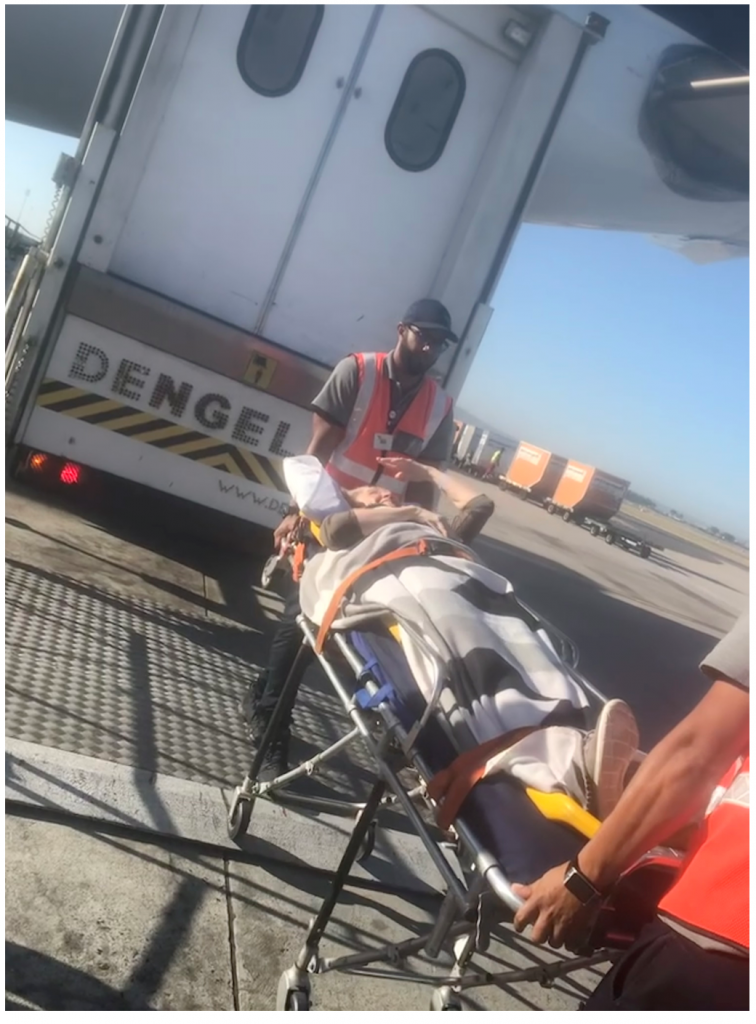

I don’t recommend a stretcher flight. You leave the hospital in an ambulance and are taken to the airport where you and your stretcher are rolled onto a scissor lift and hoisted onto the back of a 757. There, the last three rows of seats in Economy are folded down and a scaffold erected which holds a board about 2 ½ feet under the bottom of the luggage rack. They roll you off the stretcher and onto the board where you are supposed to stay immobile for the entire flight. You cannot lift your head far enough to eat or drink. If you are the least bit claustrophobic this is not for you.

Twenty-six hours, two flights and five ambulance rides later, I was back in Indianapolis. I went to the emergency room at St. Vincent’s where I saw a doctor and had an x-ray (I was billed over 6700.00 American dollars for this visit).

With all of this in mind, I will get back to the original point of this article which is to share with you what I have learned about travel insurance.

- You should always buy travel insurance if it includes coverage to get you home if you need medical care and you have no other coverage for this purpose. My stretcher flight alone was $40,000.00. Add to that the cost of five ambulance trips (one from Chicago to Indianapolis) and the escort nurses’ salaries, meals, hotels, and plane tickets, and my $100,000 in coverage was barely enough. If you should actually need medical care during your trip home, the cost could double or triple.

- Your medical insurance coverage may not be enough if your insurance company lets you languish in the hospital for three weeks while it waits for a form. My impression was that my insurer’s administrator decided that my medical insurance limits were going to be exhausted by this claim, and, since that was all they had at risk it didn’t matter how long I stayed in the hospital. I would have to cover the rest. Ask at the beginning how much your hospital will be per day and ask the insurer frequently whether your limits will cover your claim and to let you know when your limits are close to being exhausted.

- Be proactive. To avoid becoming “a file,” insist that you be copied on every communication with anyone regarding your claim. Ask to be provided with copies of any form that anyone needs to fill out on your behalf. Show the doctor the form and have him sign it and return it yourself. If you are not well enough to do this, designate someone else to receive copies on your behalf. If you are alone, be aware that most travel policies provide coverage that will pay for a relative to travel to you and assist you.

- Your treating doctor is the doctor who makes the call on getting you home. He or she must approve the method of travel for the airline to issue a ticket. While you can get a second opinion, it will add weeks to the process while the insurance company and airline debate which doctor’s opinion to accept.

- Keep receipts of all medical bills and prescription costs. Take screenshots of everything. It has been 8 months since I left South Africa and there are still billing questions. Make sure you know how to contact the hospital’s billing department, your doctor, and the local representative of your tour company.

- If you have travel insurance, in addition to medical and repatriation coverage, it will most likely include trip interruption insurance which might cover the loss of any part of your covered trip and any extra expense you ( and, in most cases, your traveling companion) incur because your trip was interrupted. These expenses include hotels, meals, extra clothing, cabs and ubers, and hospital wi-fi subscriptions. Keep receipts and email copies to yourself.

It took quite awhile to resolve my claim and to be reimbursed for the prepaid medical bills. The Co-vid quarantine hit two weeks after I got home, however, and the delay has been completely understandable. Although I spent three weeks in Cape Town, I did not see anything there except Table Mountain which was visible and spectacular outside my hospital window. I did, however, get to spend considerable time with some of its wonderful and very kind people – the best kind of travel experience you can have.